Your charitable Donations to

AMERIHAND are tax deductible

When making contributions to any charity, it is important to ask if they are designated as a tax deductible organization by the IRS. A charity that is only listed with the State is not the same. Your donation may not be deductible.

The IRS designation indicates that the organization has passed the rigorous standards set by the federal government (in addition to State) to ensure that there is transparency and proper use of funds; proper reporting of income and expenses; bylaws, and annual reports to the IRS.

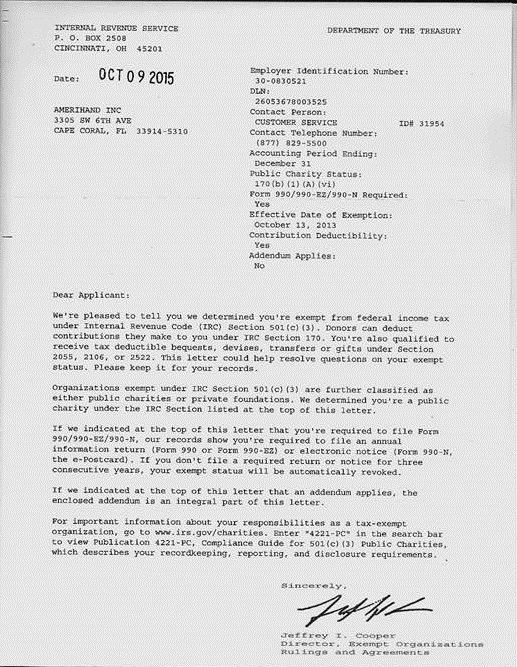

If a charity states that donations are tax deductible, they should be able to provide you with a copy of an IRS designation letter like ours we attached to the right.

Donations should only be made to the charitable organization named on the letter in order to use that organization's tax ID number on your IRS Tax Returns.

In addition to a copy of the receipt for your donation, (cash or in-kind/materials donations) your CPA may ask for a copy of this letter confirming that the charity has been fully granted the designation as a 501(c)3 public charity.